Martingale (betting system)

Originally, martingale referred to a class of betting strategies popular in 18th century France. The simplest of these strategies was designed for a game in which the gambler wins his stake if a coin comes up heads and loses it if the coin comes up tails. The strategy had the gambler double his bet after every loss, so that the first win would recover all previous losses plus win a profit equal to the original stake. Since a gambler with infinite wealth will, almost surely, eventually flip heads, the Martingale betting strategy was seen as a sure thing by those who advocated it. Of course, none of the gamblers in fact possessed infinite wealth, and the exponential growth of the bets would eventually bankrupt those who chose to use the Martingale. It is therefore a good example of a Taleb distribution - the gambler usually wins a small net reward, thus appearing to have a sound strategy. However, the gambler's expected value does indeed remain zero because the small probability that he will suffer a catastrophic loss exactly balances with his expected gain. It is widely believed that casinos instituted betting limits specifically to stop Martingale players, but in reality the assumptions behind the strategy are unsound. Players using the Martingale system do not have any long-term mathematical advantage over any other betting system or even randomly placed bets.

Contents |

Effect of variance

As with any betting system, it sometimes happens that one achieves a better result than the expected negative return, by temporarily avoiding a losing streak. Furthermore, a straight string of losses is the only sequence of outcomes that results in a loss of money, so even when a player has lost the majority of his bets, he can still be ahead overall, since he always wins 1 unit when a bet wins, regardless of how many previous losses.[1]

Intuitive analysis

When the expected value of the stopping time is finite (which is true in practice), the following argument explains why the betting system fails: Since expectation is linear, the expected value of a series of bets is just the sum of the expected value of each bet. Since in such games of chance the bets are independent, the expectation of each bet does not depend on whether you previously won or lost. In most casino games, the expected value of any individual bet is negative, so the sum of lots of negative numbers is also always going to be negative.

The martingale strategy fails even with unbounded stopping time, as long as there is a limit on earnings or on the bets (which are also true in practice).[2] It is only with unbounded wealth, bets and time that the martingale strategy can succeed.

Mathematical analysis

One round of the idealized martingale without time or credit constraints can be formulated mathematically as follows. Let the coin tosses be represented by a sequence X0, X1, … of independent random variables, each of which is equal to H with probability p, and T with probability q = 1 – p. Let N be time of appearance of the first H; in other words, X0, X1, …, XN–1 = T, and XN = H. If the coin never shows H, we write N = ∞. N is itself a random variable because it depends on the random outcomes of the coin tosses.

In the first N – 1 coin tosses, the player following the martingale strategy loses 1, 2, …, 2N–1 units, accumulating a total loss of 2N − 1. On the Nth toss, there is a win of 2N units, resulting in a net gain of 1 unit over the first N tosses. For example, suppose the first four coin tosses are T, T, T, H making N = 4. The bettor loses 1, 2, and 4 units on the first three tosses, for a total loss of 7 units, then wins 8 units on the fourth toss, for a net gain of 1 unit. As long as the coin eventually shows heads, the betting player realizes a gain.

What is the probability that N = ∞, i.e., that the coin never shows heads? Clearly it can be no greater than the probability that the first k tosses are all T; this probability is qk. Unless q = 1, the only nonnegative number less than or equal to qk for all values of k is zero. It follows that N is finite with probability 1; therefore with probability 1, the coin will eventually show heads and the bettor will realize a net gain of 1 unit.

This property of the idealized version of the martingale accounts for the attraction of the idea. In practice, the idealized version can only be approximated, for two reasons. Unlimited credit to finance possibly astronomical losses during long runs of tails is not available, and there is a limit to the number of coin tosses that can be performed in any finite period of time, precluding the possibility of playing long enough to observe very long runs of tails.

As an example, consider a bettor with an available fortune, or credit, of  (approximately 9 trillion) units, roughly the size of the current US national debt in dollars. With this very large fortune, the player can afford to lose on the first 42 tosses, but a loss on the 43rd cannot be covered. The probability of losing on the first 42 tosses is

(approximately 9 trillion) units, roughly the size of the current US national debt in dollars. With this very large fortune, the player can afford to lose on the first 42 tosses, but a loss on the 43rd cannot be covered. The probability of losing on the first 42 tosses is  , which will be a very small number unless tails are nearly certain on each toss. In the fair case where

, which will be a very small number unless tails are nearly certain on each toss. In the fair case where  , we could expect to wait something on the order of

, we could expect to wait something on the order of  tosses before seeing 42 consecutive tails; tossing coins at the rate of one toss per second, this would require approximately 279,000 years.

tosses before seeing 42 consecutive tails; tossing coins at the rate of one toss per second, this would require approximately 279,000 years.

This version of the game is likely to be unattractive to both players. The player with the fortune can expect to see a head and gain one unit on average every two tosses, or two seconds, corresponding to an annual income of about 31.6 million units until disaster (42 tails) occurs. This is only a 0.0036 percent return on the fortune at risk. The other player can look forward to steady losses of 31.6 million units per year until hitting an incredibly large jackpot, probably in something like 279,000 years, a period far longer than any currency has yet existed. If  , this version of the game is also unfavorable to the first player in the sense that it would have negative expected winnings.

, this version of the game is also unfavorable to the first player in the sense that it would have negative expected winnings.

The impossibility of winning over the long run, given a limit of the size of bets or a limit in the size of one's bankroll or line of credit, is proven by the optional stopping theorem.[2]

Mathematical analysis of a single round

Let one round be defined as a sequence of consecutive losses followed by either a win, or bankruptcy of the gambler. After a win, the gambler "resets" and is considered to have started a new round. A continuous sequence of martingale bets can thus be partitioned into a sequence of independent rounds. Following is an analysis of the expected value of one round.

Let q be the probability of losing (e.g. for American double-zero roulette, it is 10/19 for a bet on black or red). Let B be the amount of the initial bet. Let n be the finite number of bets the gambler can afford to lose.

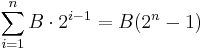

The probability that the gambler will lose all n bets is qn. When all bets lose, the total loss is

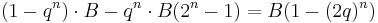

The probability the gambler does not lose all n bets is 1 − qn. In all other cases, the gambler wins the initial bet (B.) Thus, the expected profit per round is

Whenever q > 1/2, the expression 1 − (2q)n < 0 for all n > 0. Thus, for all games where a gambler is more likely to lose than to win any given bet, that gambler is expected to lose money, on average, each round. Increasing the size of wager for each round per the Martingale system only serves to increase the average loss.

Suppose a gambler has a 63 unit gambling bankroll. The gambler might bet 1 unit on the first spin. On each loss, the bet is doubled. Thus, taking k as the number of preceding consecutive losses, the player will always bet 2k units.

With a win on any given spin, the gambler will net 1 unit over the total amount wagered to that point. Once this win is achieved, the gambler restarts the system with a 1 unit bet.

With losses on all of the first six spins, the gambler loses a total of 63 units. This exhausts the bankroll and the Martingale cannot be continued.

In this example, the probability of losing the entire bankroll and being unable to continue the Martingale is equal to the probability of 6 consecutive losses: (10/19)^6 = 2.1256%. The probability of winning is equal to 1 minus the probability of losing 6 times: 1 - (20/38)^6 = 97.8744%.

The expected amount won is (1 x 0.978744) = 0.978744 . The expected amount lost is (63 x 0.021256)= 1.339118 . Thus, the total expected value for each application of the betting system is (0.978744 - 1.339118) = -0.360374 .

An alternative mathematical analysis

The previous analysis calculates expected value, but we can ask another question: what is the chance that one can play a casino game using the Martingale strategy, and avoid the losing streak long enough to double one's bankroll.

As before, this depends on the likelihood of losing 6 roulette spins in a row assuming we are betting red/black or even/odd. Many gamblers believe that the chances of losing 6 in a row are remote, and that with a patient adherence to the strategy they will slowly increase their bankroll.

In reality, the odds of a streak of 6 losses in a row are much higher than the many people intuitively believe. Psychological studies have shown that since people know that the odds of losing 6 times in a row out of 6 plays are low, they incorrectly assume that in a longer string of plays the odds are also very low. When people are asked to invent data representing 200 coin tosses, they often do not add streaks of more than 5 because they believe that these streaks are very unlikely.[3] This intuitive belief is sometimes referred to as the representativeness heuristic.

The odds of losing a single spin at roulette are q = 20/38 = 52.6316%. If you play a total of 6 spins, the odds of losing 6 times are q6 = 2.1256%, as stated above. However if you play more and more spins, the odds of losing 6 times in a row begin to increase rapidly.

- In 73 spins, there is a 50.3% chance that you will at some point have lost at least 6 spins in a row. (The chance of still being solvent after the first six spins is 0.978744, and the chance of becoming bankrupt at each subsequent spin is (1-0.526316)x0.021256 = 0.010069, where the first term is the chance that you won the (n-6)th spin - if you had lost the (n-6)th spin, you would have become bankrupt on the (n-1)th spin. Thus over 73 spins the probability of remaining solvent is 0.978744 x (1-0.010069)^67 = 0.49683, and thus the chance of becoming bankrupt is 1-0.49683 = 50.3%.)

- Similarly, in 150 spins, there is a 77.2% chance that you will lose at least 6 spins in a row at some point.

- And in 250 spins, there is a 91.1% chance that you will lose at least 6 spins in a row at some point.

To double the initial bankroll of 6,300 with initial bets of 100 would require a minimum of 63 spins (in the unlikely event you win every time), and a maximum of 378 spins (in the even more unlikely event that you win every single round on the sixth spin). Each round will last an average of approximately 2 spins, so, 63 rounds can be expected to take about 126 spins on average. Computer simulations show that the required number will almost never exceed 150 spins. Thus many gamblers believe that they can play the Martingale strategy with very little chance of failure long enough to double their bankroll. However, the odds of losing 6 in a row are 77.2% over 150 spins, as above.

We can replace the roulette game in the analysis with either the pass line at craps, where the odds of losing are lower q=(251:244, or 251/495)=50.7071%, or a coin toss game where the odds of losing are 50.0%. We should note that games like coin toss with no house edge are not played in a commercial casino and thus represent a limiting case.

- In 150 turns, there is a 73.5% chance that you will lose 6 times in a row on the pass line.

- In 150 turns, there is a 70.7% chance that you will lose 6 times in a row at coin tossing.

In larger casinos, the maximum table limit is higher, so you can double 7, 8, or 9 times without exceeding the limit. However, in order to end up with twice your initial bankroll, you must play even longer. The calculations produce the same results. The probabilities are overwhelming that you will reach the bust streak before you can even double your bankroll.

The conclusion is that players using Martingale strategy pose no threat to a casino. The odds are high that the player will go bust before he is able even to double his money.

Table limits are not specifically designed to prevent players from using Martingale strategy. The table limits exist so that the casino is not gambling more money than they can afford to lose. (E.g., a casino that takes in an average of $1000 a day on a roulette table might not accept a $7000 bet on black at that table; that bet would have a 18/38 chance of negating an entire week's profits.)

Anti-martingale

In a classic martingale betting style, gamblers will increase their bets after each loss in hopes that an eventual win will recover all previous losses. The anti-martingale approach instead increases bets after wins, while reducing them after a loss. The perception is that in this manner the gambler will benefit from a winning streak or a "hot hand", while reducing losses while "cold" or otherwise having a losing streak. As the single bets are independent from each other (and from the gambler's expectations), the same conclusions as above apply.

Betting Strategy vs. Card Counting

In a true random memoryless game any betting strategy (like Martingale) cannot improve the expected winnings. The odds of winning are entirely governed by the expected calculation of house edge. Classic casino games such as European Roulette has an expected loss of 19/37 for each play, American roulette is 10/19, Pass line bet in craps is 251/495, and the Don't pass Line is 1031/1980. Slot machines also have an expectation but it is legally permitted to be kept secret from the player in some countries. The acronym for the table that shows the probability for different outcomes for a given machine is its PARS, which is an acronym for Paytable and Reel Strips.

Card counting has a superficial resemblance to betting strategies because the initial wager is increased and decreased. However a deck of cards is not a random memoryless game. The strategy is based on the reality that a deck with many Aces and 10 value cards remaining is very likely to produce a blackjack (or natural). The blackjack is just as likely to go to the dealer as the player. However, the player gets paid a bonus for getting a blackjack (traditionally 50%) while the dealer only wins the original stake. If the player uses a strategy to estimate that the remaining cards in the deck are rich in 10s and Aces he increases his bet to take advantage of the increased possibility of a blackjack. This is one of the advantages of additional 10s and Aces. The traditional game previous to 1960 used a single deck of cards and was dealt nearly to the bottom of the deck. It was possible to invent strategies that could easily be taught to make good estimates of the number of Aces and 10s remaining in the deck. Card counting is not cheating because the player does not use subterfuge to know the outcome, he merely knows that the probabilities have changed to be more in his favor. So an effective card counter must have a large bankroll to cover the times when his initial bet is large, but the dealer still wins. Casinos have implemented multiple rule changes that make this estimation much more difficult. The easiest one is that the pit boss does not permit a wide range of initial wagers and invites the player to change to a different game if the pit boss realizes that the player has an advantage.

See also

References

- ^ "Martingale Long Term vs. Short Term Charts". Blackjackincolor.com. http://www.blackjackincolor.com/useless4.htm. Retrieved 2009-08-04.

- ^ a b Michael Mitzenmacher; Eli Upfal (2005), Probability and computing: randomized algorithms and probabilistic analysis, Cambridge University Press, p. 298, ISBN 9780521835404, http://books.google.com/books?id=0bAYl6d7hvkC&pg=PA298&dq=%22martingale+stopping%22

- ^ (wizardofodds.com/askthewizard/images/streaks.pdf)